Falling prices for petrol and used cars bring inflation down to a two-year low, as the Federal Reserve eyes a potential interest rate cut next week.

- US inflation slowed to 2.5% in August, the lowest rate since February 2021.

- Falling petrol and used car prices are key factors, though housing costs continue to rise.

- Analysts expect a 0.25% interest rate cut from the Federal Reserve next week.

Inflation in the U.S. showed further signs of easing in August, according to new government data, fueling optimism that the Federal Reserve will move forward with a long-anticipated interest rate cut. With consumer prices rising at the slowest pace since February 2021, driven by declines in petrol and used car prices, the report highlights progress in controlling inflation. However, rising housing costs and other expenses signal that price pressures remain in certain areas, keeping the outlook for future monetary policy adjustments cautious.

Federal Reserve Expected to Cut Interest Rates

Inflation in the United States continued to decline last month, according to official data, bolstering expectations that the Federal Reserve will lower interest rates at its upcoming meeting. Consumer prices rose by 2.5% over the 12 months leading to August, a slowdown from the 2.9% increase seen in July. This marks the lowest inflation rate since February 2021, driven by falling prices for petrol, used cars, trucks, and other goods, despite a surprising uptick in housing costs.

The figures, released by the Labor Department, come amid a heated presidential campaign where the rising cost of living remains a key issue. Analysts are now predicting a 0.25 percentage point interest rate cut by the Federal Reserve, though the chances of a larger reduction have diminished.

Paul Ashworth, Chief North America Economist at Capital Economics, commented, “Inflation appears to have been tamed, but housing inflation remains stubborn, indicating the battle is not yet over.”

While grocery prices were stable between July and August, other costs, such as rent, airline tickets, and car insurance, continue to rise. Analysts caution against overconfidence, with Brian Coulton of Fitch Ratings noting, “This data suggests the Federal Reserve will cut rates, but the persistence of inflation in services means future cuts will likely be gradual.”

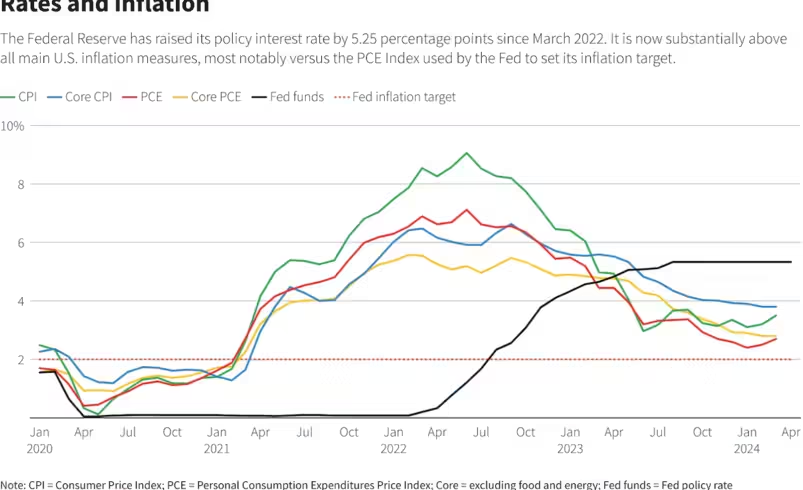

The Federal Reserve began raising interest rates in 2021 to combat inflation, which surged due to pandemic-related supply issues and heightened global oil prices following Russia’s invasion of Ukraine. US inflation peaked at 9.1% in June 2022, but has since been brought closer to the 2% target considered healthy.

Slowing Labor Market and Economic Concerns

While inflation has moderated, the Federal Reserve is also grappling with signs of a slowing labor market. Job creation has slowed significantly since April, raising concerns about a broader economic slowdown.

Central bankers now view preventing a recession as equally important as fighting inflation, which reached a 40-year high in 2022.

Market indicators, such as the recent reversal of the inverted yield curve, point to expectations of lower interest rates and a possible economic downturn. Treasury yields have hit their lowest levels in over a year, suggesting that markets are already factoring in potential rate cuts from the Fed next week.

Post Views: 27