Kiyosaki warns of impending financial collapse; Trump and Lummis propose Bitcoin reserves as potential remedies

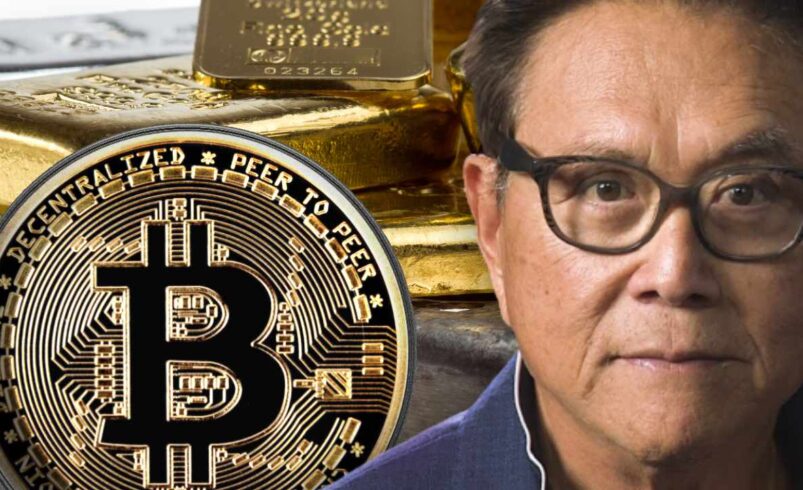

- Robert Kiyosaki’s Warning: The financial expert warns of a looming collapse due to the soaring U.S. national debt and suggests investing in gold, silver, and Bitcoin as a safeguard against the weakening dollar.

- Trump and Lummis’ Bitcoin Proposals: Former President Donald Trump and Senator Cynthia Lummis propose using Bitcoin reserves to tackle the national debt, with Trump suggesting long-term holding strategies and Lummis advocating for a strategic reserve.

- Financial Concerns Escalate: Recent credit rating downgrades and fiscal warnings from figures like Senator Rand Paul and investor Jeffrey Gundlach highlight the urgent need for effective solutions to manage the U.S. national debt and prevent economic instability.

As the U.S. national debt surges past $35 trillion, financial experts and political figures are proposing bold, unconventional strategies to tackle the crisis. Robert Kiyosaki, bestselling author of *Rich Dad Poor Dad*, has raised alarms about a looming financial collapse, urging investment in gold, silver, and Bitcoin as alternatives to the faltering U.S. dollar. Meanwhile, former President Donald Trump and Senator Cynthia Lummis have introduced controversial ideas involving Bitcoin reserves to address the debt crisis. These proposals reflect a growing debate over the most effective way to stabilize the U.S. economy amid escalating financial challenges.

Kiyosaki Warns of Financial Collapse and Banking Crisis

In a series of recent posts, Robert Kiyosaki, renowned for his financial advice book *Rich Dad Poor Dad*, has expressed serious concerns about the United States’ burgeoning national debt, which now stands at a staggering $35 trillion. Kiyosaki asserts that neither former President Donald Trump nor Vice President Kamala Harris has the solutions to this escalating crisis.

Kiyosaki warns that the U.S. is inching closer to a financial collapse, highlighting the alarming rate at which the national debt is growing—by $1 trillion every 100 days. With annual interest payments exceeding $1 trillion, he suggests that the current financial system, which he labels as “fake money,” is unsustainable. To combat this, Kiyosaki is pushing for investments in physical assets like gold, silver, and Bitcoin, arguing that these assets will retain their value as the dollar continues to weaken.

Additionally, Kiyosaki has raised the alarm about a potential banking crisis, which he describes as “hidden” and more perilous than traditional market crashes. Unlike market crashes, which allow for some preparation time, banking collapses can occur abruptly and present significant risks to the financial system.

Former President Donald Trump has recently proposed a controversial strategy to address the national debt by leveraging Bitcoin. In a recent interview, Trump suggested that acquiring a substantial reserve of Bitcoin could help offset the national debt. His plan involves the U.S. government purchasing a large amount of Bitcoin, holding it for two decades, and then selling it at a potentially higher value to reduce the debt. Trump’s idea is based on the belief that Bitcoin’s value could soar to millions of dollars per coin over the next few decades, thus generating significant profit to help mitigate the national debt.

This proposal has ignited debate among economists. Some view it as an innovative solution, while others question its feasibility, given Bitcoin’s inherent volatility and the unpredictable nature of the cryptocurrency market.

Credit Rating Downgrades and Fiscal Warnings Highlight Growing Concerns

The urgency of addressing the U.S. national debt crisis is underscored by recent financial warnings and credit rating downgrades. In November of last year, Moody’s downgraded the U.S. credit rating to “negative,” citing the rising deficits and debt burdens. U.S. Senator Rand Paul has echoed these concerns, stating that unchecked government spending threatens the dollar’s stability. “The greatest threat to our national security is the national debt,” Paul declared, noting that $1 trillion was borrowed in just the past three months. Similarly, renowned billionaire investor Jeffrey Gundlach warned of the dangers posed by the massive budget deficit and increasing interest rates, urging that the future of the U.S. dollar and inflation control depends on stringent budget and spending reforms.

Post Views: 37